Hey Founder,

You’re busy. We get it. That’s why we’ll keep this brief… like a pitch deck that actually gets read.

We launched this newsletter to cut through the noise and deliver the good stuff: actionable insights, relevant network boosts and zero time-wasting.

🎙️ People you need to know: Meet Tony Wu

Why read this? Because this gives you the cheat code to their brain. Get a feel for their vibe and whether they're worth a dedicated follow-up.

Tony Wu is part of the Plug and Play team, where he works on bridging startups with global corporates and innovation ecosystems across Hong Kong, Asia, and Silicon Valley. Having lived and worked in Los Angeles, Hong Kong, and Mainland China, he brings a cross-border perspective to helping founders scale, navigate enterprise partnerships, and access global markets.

Plug and Play’s Tony Wu

Q: Tony, you’ve seen thousands of pitches. What’s the fastest way for a founder to lose your attention?

A: When a founder says they have no competitors. That usually signals one of two things: either the market isn’t real, or the market research hasn’t been done thoroughly. Every meaningful problem has existing alternatives, even if they’re indirect. Founders who understand that landscape tend to be much more grounded and credible.

Q: What’s the one metric you check first when evaluating a startup?

A: Revenue quality for post-revenue startups, and product–market fit for pre-revenue teams. If a startup has revenue, I want to understand who is paying and why — whether customers are concentrated, repeat users, or expanding usage over time. For pre-revenue teams, I look for early signs of real customer pull rather than assumptions.

Q: In the current funding climate, what’s a “red flag” founders often overlook in their own operations?

A: One common issue is not having full clarity yet on why external capital is needed — which is very normal, especially for early-stage teams. When we ask this question, it’s usually not to challenge ambition, but to understand priorities. Funding works best when it’s used to accelerate focus, whether that’s scaling what’s already working, learning faster, or unlocking opportunities that wouldn’t be possible otherwise.

Q: Let’s give founders an edge. What is your “secret sauce” category for early-stage investment right now?

A: The founder story — not just the résumé, but the person behind it. At an early stage, how founders think, learn, and respond to uncertainty matters a lot. Those qualities don’t always show up in polished decks, but they become very clear through real conversations.

Q: You’re currently a key part of the Plug and Play team. For founders reading this, what does that global network unlock for a startup from Hong Kong or in Asia?

A: We’re still in the planning phase of tailoring accelerator programs specifically for Hong Kong, but the direction is clear. First, we aim to bring high-quality startups into major innovation hubs like Silicon Valley, Stuttgart, and Mainland China, and connect them directly with global corporations. Second, we want to help bring practical innovation know-how — particularly around how startups and corporates can work together effectively to HK.

Q: What’s a fun, non-investment related hobby you’ve picked up recently that helps clear your head?

A: Hunting for spicy food! I’m always on the lookout for something with real heat — Mexican, Chinese, anything. It’s a fun way to explore new neighbourhoods.

📈 What’s hot, what’s not

Hot 🔥

Cyberport HK’s new ABC service centre: ABC meaning AI Models, Big Data and Cybersecurity. The centre aims to showcase the latest AI and data service plans, and compute offerings and funding schemes, designed to accelerate innovation for AI and digital tech startups. Great news if you’re in that space! That being said, we do wish that Cyberport could have come up with a more inspiring name than “ABC"… 😅

SpaceX’s infrastructure premium: The rumoured $1.5 trillion valuation for the SpaceX IPO isn't just a financial story; we see it as a market signal. It confirms that the largest capital pools are now valuing deep, capital-intensive infrastructure over asset-light software.

AI-native, vertical agents: The era of building just another SaaS is fading. We are hearing from founders who are getting massive investor interest by embedding Generative AI into highly specific, complex workflows (eg. compliance, diagnostics, tech automation etc).

Building for strategic expansion: Don't just build for Hong Kong; build from Hong Kong (or from whichever city your HQ is in). Smart founders are making end-of-year focus shifts to 2026 expansion plans, and investors are taking note.

Not 🥶

Relying on a teen pipeline for growth: On December 10, Australia's ban on social media for under-16s went into effect. It's a world-first, but it won't be the last. For founders targeting teen consumers, take note: your future user base and marketing strategy cannot be held hostage by a Big Tech platform's ability (or inability) to comply with new global age-gating laws. The real danger is the potential for other APAC markets to adopt similar policies. Startups whose growth model relies on low-cost, high-volume youth acquisition via Instagram or TikTok is now facing market risk and a shrinking Total Addressable Market (TAM).

The 'growth-at-all-costs' mindset": VCs are still scrutinising burn rates. Founders who still chase vanity metrics and capital-inefficient growth are struggling. Capital efficiency is the new moat!!!

The solo operator: Going it alone is sooo 2022. In today's connected world, there’s no reason why founders can’t leverage accelerators and strategic partnerships (university tech transfer, corporate ventures). Partners are a non-negotiable for visibility and credibility.

💡Quick tip : Is your valuation cap just right?

Finding the sweet spot for your valuation cap feels like guessing. But what if you could test it with low stakes? Spoiler: You can!

We're talking about the mini-tranche test. Think of it as a limited-edition drop of special fundraising terms.

Here’s how: When you offer a small, initial chunk (a tranche) of your convertible notes or SAFEs at specific terms, you get immediate feedback on your valuation cap without betting the whole farm.

Your cap checklist ✅💰💰

🤗 If the first tranche is GONE immediately:

The signal: You have massive demand, and investors are fighting to get in on those terms.

The reality check: Congrats on the momentum! But your cap is likely too low. You were giving away more future equity than you needed to.

Your move: Raise the cap for the next tranche. You just got market proof that you're worth more.

🫣 If the first tranche is crickets:

The signal: Very little or no interest, even with the "special early bird" terms.

The reality check: You either have a cap that's too high and scaring people away, OR you have a bigger foundational problem with your business/pitch.

Your move: Pause and re-assess. If your cap seems reasonable, take a hard look at your pitch and traction.

The best part of this test run? Even if you get the pricing wrong on that first small chunk, the equity sacrifice is minimal, but the momentum you create is invaluable.

🎁 New workshop: Get that HKSTP grant

We're hosting a workshop: "How to Increase Your Chances of Getting into HKSTP."

Why bother? Getting into HKSTP isn't just about the cash. It's validation, resources, network access, and a badge of credibility that makes future investors sit up and pay attention.

When: Early 2026 (Dates TBD)

2 Sessions: English and Cantonese.

Simply send us a blank email and you’ll get the invitation next year!

✨ Why your Angelflow profile needs a glow-up

The holiday season is here! 🎁🎄 While your competitors are wrapping gifts, you should be wrapping up your profile. Investors usually slow down in December, giving them time to browse Angelflow profiles they missed.

Oh and if that isn’t enough of a reason, did you know that we also choose the best Startup profiles on Angelflow to feature them in our other newsletter targeted specifically for Investors? 🤩

Your quick task for today (5 minutes, max)

It's time for a profile refresh.

Log in to Angelflow.

Update your profile. Seriously. If it looks like you haven't touched it since signing up, you're missing out.

Share an update. The newsfeed ensures you’re top of mind for investors who have shown interest in your startup.

Discover/Follow relevant angels who fit your category.

Don't be the founder with the outdated profile when Investors start making their 2026 'hot list'!

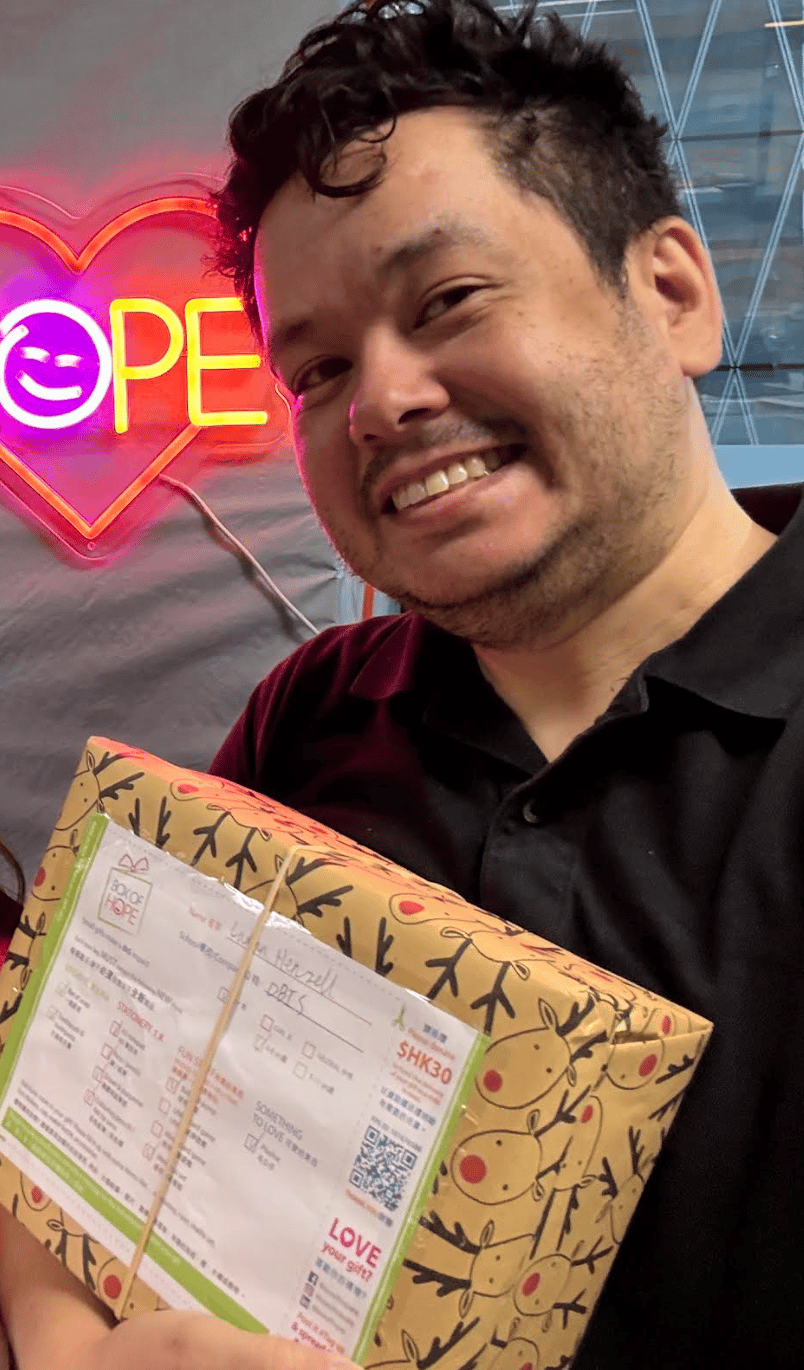

🎄 Bringing joy: Angelflow gives back 🎁

Stepping away from deal flow and data, the Angelflow team recently spent a day volunteering at Box of Hope HK.

We enjoyed checking, decorating, and packing gift boxes filled with essential and fun items for underprivileged children across Hong Kong and Asia ahead of the festive season.

Til next time,

The Angelflow Team

P.S. Know a founder who needs support? Or someone just thinking about launching a startup? Forward them this Playbook. Sharing is caring (and good networking karma).