🌟 Guiding your first (or next) steps in the world of startup investing

Welcome to the inaugural Market Notes, your regular briefing on early-stage opportunities and market dynamics across Asia.

At Angelflow, our mission is to make angel investing into startups accessible, simple and trustworthy. This briefing is designed to highlight important market news, deliver exclusive access to founders, and help you discover the next generation of innovation.

But before we get into it, I want to acknowledge the community of Tai Po in Hong Kong, who are recovering from the fire tragedy. We at Angelflow are inspired by the resilience and unity demonstrated by local citizens and organisations, and our thoughts and prayers go to all those affected.

I recently had the pleasure of speaking to a group of bright, aspiring entrepreneurs at Hong Kong Baptist University about the entrepreneurial mindset. My main message to them was simple, but I believe it’s the foundation of every meaningful startup journey: find a real problem to solve, and have the courage to take action. Too often, early founders chase trends or copy what’s been done, thinking that a slightly shinier version of an existing idea will be enough. But the ones who truly break through are the ones who dig deep, see a real pain point in the world, and then build something that matters.

Over the years, I’ve noticed something fascinating when listening to pitches. There are founders who talk about features, and then there are founders who talk about a vision. The difference is night and day. Features describe what a product does; vision describes why it matters. And the founders who know how to tell that story, who can paint a vivid picture of the future they’re building and the problem they’re solving for real people, are the ones who make investors lean forward in their chairs.

Liz

📰 The latest in startups

Promising new figures show Hong Kong's startup ecosystem surges 40% in just 5 years

Congrats to Fintech startups in Asia! India’s Finfactor nets $15m series A; while the Philippines’ Higala closes $4M seed

Uolo, an edtech startup that partners with schools across India to provide textbooks and a home-practice app, has raised $7m

Meanwhile, money is flowing in Singapore too, with deep-tech startup SynaXG raising over $20m in its first ever funding round, AI-for-Science startup ChemLex raising $45m, and real estate investment platform RealVantage raising $10m in an oversubscribed series A.

Unsurprisingly, Hong Kong’s Klook is said to delay it’s US IPO til next year… well, seeing we’re already in December this isn’t a big shock to anyone. 🤔

etaily, the third fastest growing company in APAC, and the fastest growing in the Philippines, secures additional funding from SMBC Asia Rising, a fund run by Japan’s Sumitomo Mitsui Banking Corporation. The actual figure raised in this round? That’s been kept hush-hush. 🤫

Ouch! Losses from shopping transaction scams in Indonesia have reached $666.6m 👿

Merck announces new semiconductor materials facility in Kaohsiung’s Lujhu District, signalling rising demand. 📈

✨ Founder spotlight

In every newsletter, we will introduce an exemplary founder who is creating something exciting. Our team carefully selects these founders, as they keep us updated by maintaining their Angelflow profile and posting regular updates. We love learning about their work and progress, and we’re sure you will too.

Introducing meed: the universal loyalty layer

We sit down with Phil Ingram, CEO and Founder of meed, a rising star based in Hong Kong tackling the trillion-dollar problem of dormant retail loyalty.

Phil's 25-year career, from scaling Hong Kong's first commercial ISP to Web3 CMO, taught him a core truth: sustainable customer retention is more valuable than endless acquisition.

The problem: We've all faced it: the 20-minute sign-ups, the forgotten passwords and the clutter of physical stamp cards. Phil was frustrated by the consumer friction and the trillion-plus-dollar hole in lost retail opportunities caused by half of all loyalty programs being dormant.

The solution: meed is the universal, AI-powered loyalty layer. It offers independent businesses a simple, one-minute, no-code setup, while consumers get a single, app-less wallet accessed directly from their phone's browser. Loyalty becomes a 10-second tap, not a chore.

🔑 Phil's vision: “meed won't be a loyalty company; it will be the definitive data oracle for SME consumer behaviour, as ubiquitous for local commerce as Facebook is for social connection.”

meed at Staunton’s Hong Kong

🚀 Positioned for growth

meed is the only platform solving loyalty for both sides of the market, transforming a $25 billion back-of-house industry into a demand-driven marketplace.

The unfair advantage: By providing simple solutions to both consumers and businesses, meed is building a unique, anonymised dataset of consumer behavior. This data powers their AI, Sprig, enabling hyper-personalised, automated rewards that no single retailer can match.

📈 Traction & next steps

Since its V1 launch this year, meed has organically grown to 350+ accounts with inbound interest from over 60 countries. They are now converting free users to paid.

Momentum into December:

Successful Thai launch: We successfully launched our first super-reseller partnership in Thailand with a view to onboarding 1,000 retailers across the country in 12 months.

Product upgrade complete: Our completely new loyalty UI, which cuts down the onboarding to a fully functional loyalty program to a two-minute form, is now live and being rolled out to customers.

Investor roadshow (Dec): This month, we embark on an investor roadshow in Dubai, a key launch city for the meed Network.

Phil Ingram (left) and the team at meed

💡 Investment opportunity: Pre-seed round

meed is raising a $500K–$750K pre-seed round to systematically convert their proven organic demand into high-value paying customers.

Phil is looking for partners who offer more than capital:

Operational expertise in scaling B2B2C SaaS or two-sided marketplaces.

Strategic connections to key partners, merchants, and future investors.

A Founder-first mindset: serving as a strategic sounding board.

Intrigued by Phil's long-term vision? meed is looking for investors and potential partners who are as passionate about the data oracle vision as they are about near-term execution.

➡️ Click here to view meed's profile on Angelflow and connect/follow them to see their journey.

🎓 Ready to lead? The angel syndicate manager workshop (New Year 2026)

Have you considered leading your own deals and guiding fellow investors? Becoming a syndicate manager allows you to:

Shape the flow: Source and back the startups you are most passionate about.

Earn carried interest: Get rewarded for your expertise and leadership.

Build your brand: Establish yourself as a leader in the Asian startup ecosystem, and build your track record for your ambitions of managing your own fund as a VC

If this next-level opportunity interests you, get in touch to express your interest!

🤝 Co-invest with confidence: Join the Angelflow angel syndicate, The Circle

For those looking for a curated approach, our members-only angel syndicate provides the opportunity to co-invest alongside the Angelflow team in deals that have passed our rigorous due diligence. What does this mean? We’re only sharing deals that we have personally invested in, too, so you can participate with confidence. Bonus: it’s free to join. We think it’s an excellent way to start angel investing and diversifying your early-stage portfolio!

🚀 Are you interested in Secondaries for later-stage startups?

Secondaries are becoming one of the most compelling ways to gain exposure to high-growth startups beyond the early stages.

So what exactly are Secondaries?

Secondary investments involve purchasing existing shares from current shareholders, be it from early employees, founders or even prior investors, rather than buying newly issued shares in a funding round.

What makes Secondaries so attractive?

Access to mature startups approaching IPO or other liquidity events

Reduced risk compared to earlier-stage entries

Diversification across high-performing private companies

If you’d like to learn more about how to invest in Secondaries or explore our current opportunities, we’d love to connect.

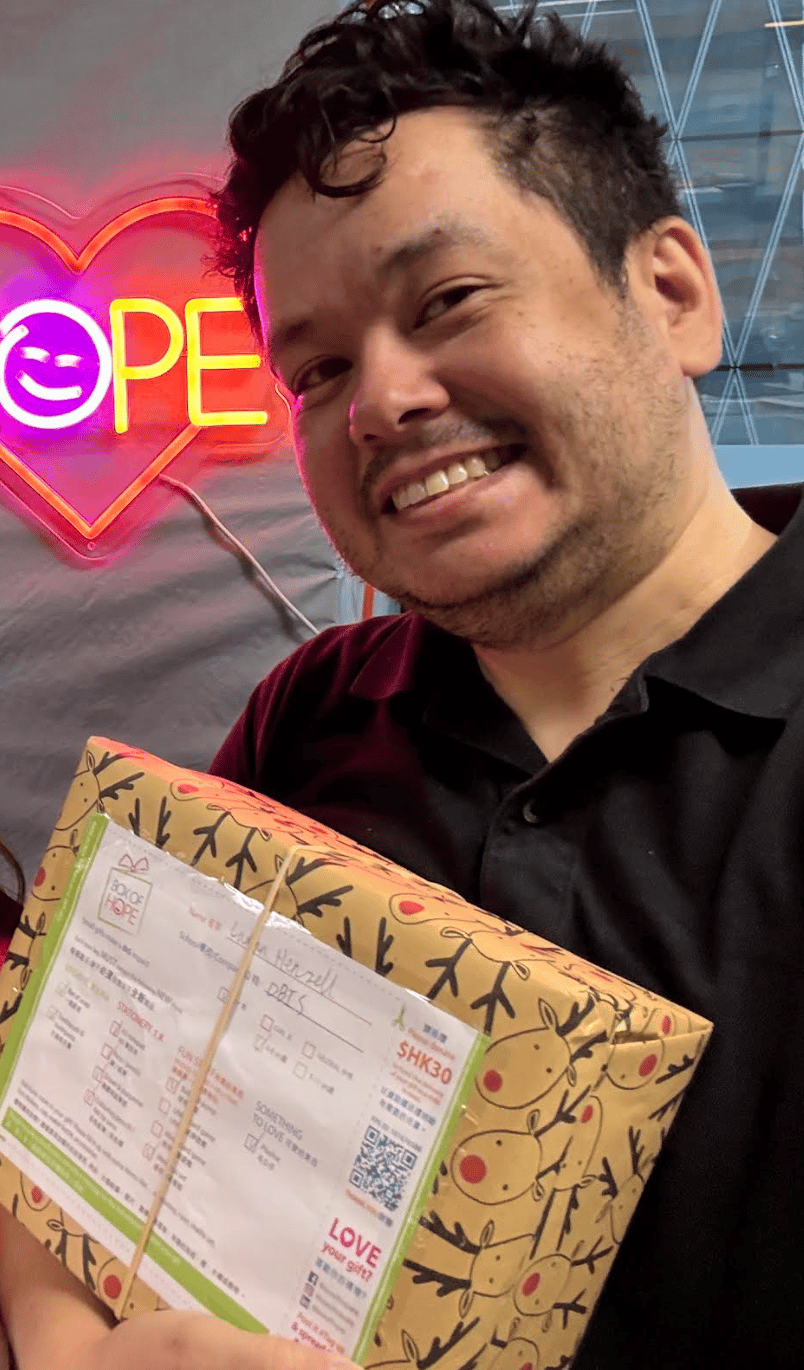

🎄 Bringing joy: Angelflow gives back 🎁

Stepping away from deal flow and data, the Angelflow team recently spent a day volunteering at Box of Hope HK.

We enjoyed checking, decorating, and packing gift boxes filled with essential and fun items for underprivileged children across Hong Kong and Asia ahead of the festive season.

Did you know? When Alibaba’s Jack Ma used the internet for the first time, his very first search was for "beer". 🍻

Till next time,

The Angelflow team

P.S. Knowledge is power… and better shared! If you know a friend who is curious about the world of angel investing, please forward this email to them or encourage them to reach out to the Angelflow team to learn how to get started.